SAP Business One - FIFO Method Of Stock Valuation

The FIFO method assumes that the first items received into inventory are the first ones to be sold. This method matches the cost of goods sold (COGS) with the oldest inventory costs, which can provide a more accurate representation of costs when prices are changing over time.

FIFO valuation under perpetual inventory system

| Date | Transactions | Units Sold | Unit Cost | Inventory Units |

| May 1 | Beginning Inventory | 700 | $10 | 700 |

| May 3 | Purchase | 100 | $12 | 800 |

| May 8 | Sale (*1) | (500) | ?? | 300 |

| May 15 | Purchase | 600 | $14 | 900 |

| May 19 | Purchase | 200 | $15 | 1,100 |

| May 25 | Sale (*2) | (400) | ?? | 700 |

| May 27 | Sale (*3) | (100) | ?? | 600 |

| May 31 | Ending Inventory | ?? |

(*1) 500 units sold

= 700 units from beginning inventory of at $10 unit cost.

Cost of goods sold = 500x$10 = $5,000

(*2) 400 units sold

= 200 units from beginning inventory at $10 unit cost

+ 100 units from May 3 purchases at $12 unit cost

+ 100 units from May 15 purchases at $14 unit cost

Cost of goods sold = 200x$10 + 100x$12 + 100x$14

= $2,000 + $1,200 + $1,400 = $4,600

(*3) 100 units sold

= 100 units from May 15 purchases at $14 unit cost

Cost of goods sold = 100x$14 = $1,400

Total cost of goods sold

= 500x$10 + 200x$10 + 100x$12 + 100x$14 + 100x$14

= $5,000 + $2,000 + $1,200 + $1,400 + $1,400

= $5,000 + $4,600 + $1,400 = $11,000

Cost of ending inventory

= Beginning inventory + Cost of purchases - Cost of goods sold

= $7,000 + (100x$12 + 600x$14 + 200x$15) - $11,000

= $7,000 + $12,600 - $11,000 = $8,600

[Checking]

Quantity of ending inventory

= Beginning inventory + Units purchased - Units sold

= 700 + 900 - 1,000 = 600 units

Cost of ending inventory

= 400 x $14 (May 15 purchase) + 200 x $15 (May 19 purchase)

= $5,600 + $3,000 = $8,600

In SAP Business One, the FIFO method is typically implemented as follows:

Configuration: In the system settings, you would specify that you want to use the FIFO method for inventory valuation.

Goods Receipt: When you receive new items into inventory, the system records their cost. The cost of the newly received items is associated with the most recent purchase price.

Goods Issue: When items are sold or used, the system uses the cost of the oldest items in inventory to calculate the cost of goods sold. This ensures that the COGS reflects the cost of the earliest inventory purchases.

Inventory Valuation: The inventory value on the balance sheet is determined by the cost of the remaining items in inventory, which are the most recently received items.

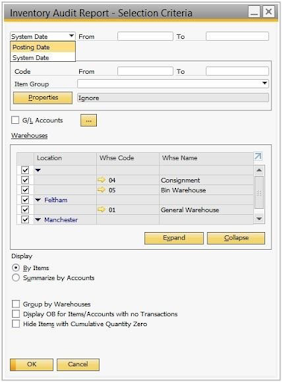

Reporting: SAP Business One provides reports that display the value of inventory, cost of goods sold, and other financial information based on the FIFO method.

It's important to keep in mind that the FIFO method can lead to higher COGS during periods of rising prices, as older inventory with lower costs is matched with revenue. This can impact profitability and tax calculations.

Comments

Post a Comment