SAP Business One - Moving Average Costing Calculation

In the moving average method of inventory valuation, the average cost of items in inventory is recalculated each time new stock is received. This average cost is determined by taking the total cost of all items in inventory and dividing it by the total quantity of items.

Here's how the moving average method works in SAP Business One:

Initial Setup: In SAP Business One, you would set up your inventory items and specify that you want to use the moving average method for valuation.

Goods Receipt: When you receive new items into inventory, the system calculates the new average cost based on the cost of the incoming items and the existing items in inventory.

Goods Issue: When items are sold or used, the system adjusts the inventory value and cost of goods sold based on the moving average cost.

Recalculation: Each time new stock is received, the moving average cost is recalculated by considering the total value of the existing inventory and the newly received items.

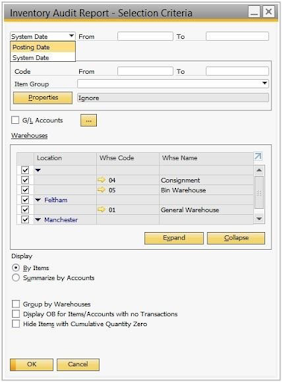

Reporting: SAP Business One provides reports that show the value of inventory, cost of goods sold, and other financial information based on the moving average method.

Moving Average valuation under perpetual inventory system - See below Example

(*1) Average cost of 800 units

= (700x$10 + 100x$12) / (700 + 100)

= ($7,000 + $1,200) / 800 = $8,200 / 800 = $10.25

Cost of goods sold on May 8 = 500x$10.25 = $5,125

(*2) Average cost of 900 units

= (300x$10.25 + 600x$14) / (300 + 600)

= ($3,075 + $8,400) / 900 = $11,475 / 900 = $12.75

(*3) Average cost of 1,100 units

= (900x$12.75 + 200x$15) / (900 + 200)

= ($11,475 + $3,000) / 1,100 = $14,475 / 1,100 = $13.16

Cost of goods sold on May 25 = 400x$13.16 = $5,264

Cost of goods sold on May 27 = 100x$13.16 = $1,316

Total cost of goods sold

= 500x$10.25 + 400x$13.16 + 100x$13.16

= $5,125 + $5,264 + $1,316 = $11,705

Cost of ending inventory

= Beginning inventory + Cost of purchases - Cost of goods sold

= $7,000 + (100x$12 + 600x$14 + 200x$15) - $11,705

= $7,000 + $12,600 - $11,705 = $7,895

[Checking]

Quantity of ending inventory

= Beginning inventory + Units purchased - Units sold

= 700 + 900 - 1,000 = 600 units

Cost of ending inventory

= 600 x $13.16 (Moving Average cost per unit as of May 31)

= $7,896

$7,896 - $7,895 = $1 (rounding error)

It's important to note that the moving average method provides a smoother valuation compared to methods like FIFO or LIFO, as it spreads the cost of purchases across all inventory items. This can be especially useful when there are frequent price fluctuations or when managing perishable goods.

Comments

Post a Comment